Most companies forget about SaaS renewals until the bill hits, and it's too late to act. Whether a tool goes unused and quietly auto-renews or a contract jumps to a higher price, the result is the same: wasted spend and zero visibility.

That reactive approach, waiting for the bills, might have worked when software renewals were rare and easy to track. But today’s SaaS environment is different; teams rely on dozens or even hundreds of tools across departments.

This means SaaS renewal dates are scattered across systems, usage data is incomplete, and stakeholders often scramble to decide if a tool is worth keeping, with just hours or days to spare.

This post will break down why most software renewal management methods fail and how you can fix them. You’ll learn how to:

- Stay ahead of upcoming SaaS renewals

- Avoid surprises and last-minute negotiations

- Reduce wasted spend and eliminate shelfware

- Improve vendor relationships and compliance

TL;DR

- Scattered SaaS ownership, hidden contract clauses, and unclear usage data make software renewals complex and error-prone.

- Centralizing contracts, assigning clear owners, setting automated alerts, and reviewing usage early helps teams avoid last-minute surprises and wasted spend.

- Before renewing any software, ask if it’s actively used, delivering measurable value, free of overlaps or orphaned seats, and worth the contract terms.

- SaaS renewal management tools like Stitchflow surface unused licenses, track real usage, and provide actionable insights to optimize spend across the organization.

Why software renewal management breaks in modern companies

Before diving into the best practices for software renewals, let’s look at why they break in the first place. The number of SaaS tools and complexity have exploded, especially across fast-growing companies. Here’s where things tend to fall apart:

Too many apps, too little oversight

Teams often buy tools independently, bypassing the central IT team. Different departments may be responsible for various apps, each with its own budget and priorities. Adding to the complexity, most organizations split responsibilities: procurement typically tracks contracts, while IT handles justification, negotiation, and determining license counts or feature sets.

In small organizations, this is even more fragments—sometimes each employee is responsible for renewing their tech stack with barely any oversight.

With app ownership and renewal responsibilities split between different stakeholders, it becomes tricky to coordinate software renewals or track spending holistically.

No visibility into usage or value

No one knows whether or by whom the renewed software is being used. In many cases, licenses remain assigned to users who left the company months ago. Without visibility into usage, IT and finance are operating in the dark.

‼️For example, this one company had both Google Workspace and Microsoft Office licenses, and employees rarely used the latter. Their IT manager says 40% of them hadn’t opened their MS Office apps even once.

Auto-renewal traps

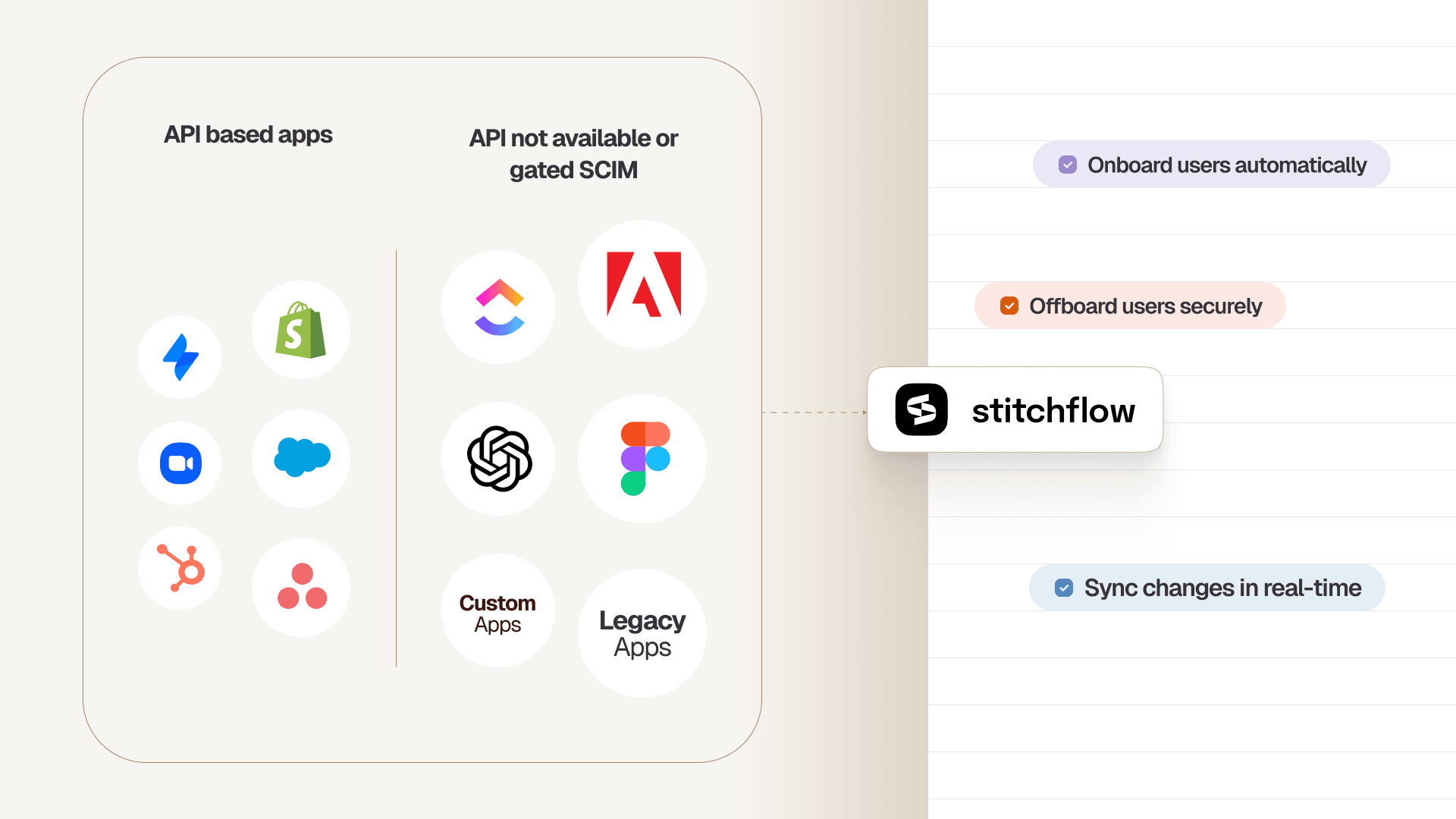

Here's how it works: Vendors know that managing apps manually is unsustainable as you grow. So, they create a powerful driver for you to upgrade by locking critical automation features, like SCIM provisioning, behind expensive, "all-or-nothing" enterprise plans.

This "SCIM Tax" forces teams into a corner: either pay a massive premium for automation, or stick with the manual plan and guarantee you'll miss things and waste money.

This is where the auto-renewal clause springs the trap. If your team misses that narrow 30-day cancellation window, you're not just locked into another year—you're often locked in at a higher price, with no chance to negotiate or adjust terms.

‼️Here’s what happened to one customer on an annual auto-renewing contract: They were notified of a price increase and offered a discounted two-year option. The customer requested to review their original contract with their new legal and finance team, but did not respond, leaving the renewal decision unresolved as the deadline passed.

This illustrates the risk: if the cancellation or negotiation window is missed, organizations can be locked into another year of fees—often at a higher price—without the chance to review or adjust terms.

Zero time for strategy

Software renewals are often flagged at the last minute—or not at all—leaving little room for thoughtful analysis, stakeholder input, or negotiation. As a result, software gets renewed by default rather than by design, and opportunities to adjust contracts are missed.

‼️For example, one organization spent several months trying to renew and reactivate an expired Rapid7 license. The process involved multiple customer success reps, several support cases, and dozens of emails. So much so that the team was left without access to the platform for about a month.

Without proactive planning and integrated renewal workflows, IT and finance teams remain reactive, and software spend—and usage—continues to slip out of control.

Best practices for better software renewal management

Here’s how to bring structure, clarity, and control to your software renewal process.

1. Centralize your renewal calendar—but tie it to usage, not just dates

You can’t fix what you can’t see. A renewal calendar should be more than a list of contract end dates—it should connect each tool to license counts, active usage, and a responsible owner. That way, when a renewal approaches, you have the context they need to decide whether to renew, reduce, or retire the tool instead of defaulting to auto-renew.

Not sure where to start? Renewal Tracker by Stitchflow is a free tool that scans your contracts, extracts renewal dates, and sets up automated reminders—giving you a clear line of sight into what’s expiring and which apps need deeper review.

2. Assign ownership for every tool

Every SaaS tool needs a clear business owner. That person monitors usage, prepares renewals, and coordinates with finance or procurement. When ownership is unclear, decisions fall through the cracks.

Renewal planning is the perfect time to fill these gaps. As you review contracts, document who owns each app, what team relies on it, and how decisions about renewals will be made. This ensures accountability, speeds up renewal reviews, and prevents contracts from slipping through the cracks simply because “nobody knew who was responsible.

3. Review usage at least 30–60 days before renewal

Give yourself time to act. Reviewing usage patterns, license allocations, and budget implications at least 30–60 days before a renewal date is critical.

If you wait too long, you lose negotiating leverage and risk getting stuck with status quo pricing.

While this 60-day review is smart, the real solution is to prevent renewal waste in real-time. Manually revoking access just before a contract renews is still a reactive, time-consuming task.

Stitchflow’s core value is automating this action the moment it happens. When an employee is offboarded in your IDP (like Okta or Google), Stitchflow's SCIM bridge triggers immediately. Using resilient browser automation, it logs into that disconnected app and deprovisions the user, just as a human would, but with 100% reliability.

This approach transforms your renewal prep. Instead of scrambling to find problems, you're simply confirming the savings. Stitchflow’s IT Graph—which links user activity, HR data, and IDP records—provides the clean report.

You can see exactly which accounts are truly active and which licenses are sitting idle, allowing finance to right-size the spend with confidence.

By the time you review the app 60 days before renewal, the waste has already been eliminated. You aren't finding problems; you're preventing them.

“We cut $22K in renewals last quarter just by checking Stitchflow’s usage trends and dropping tools no one touched in 90 days.”

– Stitchflow customer

Unlock SCIM for any app without the enterprise upgrade

Trigger automated provisioning in your IdP just like native SCIM. Enabled by resilient browser automation, backed by 24/7 human monitoring, at a fraction of the enterprise plan cost.

4. Automate alerts, not just calendar events

Calendar events can be missed or ignored. Automated alerts—with the proper context—are more complicated to overlook because they show up where your teams are already working. Instead of just adding calendar reminders, set up renewal workflows that trigger:

- Slack or Microsoft Teams notifications

- Tasks or reminders in your ticketing system (like Jira or ServiceNow)

- Emails with detailed usage context and renewal history

This ensures stakeholders are looped in and decisions aren’t delayed due to a lack of visibility.

🎯Pro tip: Set up automated renewal workflows in your SaaS management software that trigger well in advance—90 to 180 days before the contract end date—based on contract size and type. Pull in the right stakeholders automatically:

- Route high-value contracts (over $100K TCV) to your finance team

- Assign smaller contracts to IT managers or department heads

This ensures timely action and keeps software renewals under control.

5. Prioritize tools with the highest renewal risk

Not every tool in your stack deserves the same level of scrutiny. Some renewals are higher-stakes—financially or operationally—and should be prioritized.

Look closely at tools that are:

- High cost: Large contracts often have more room for negotiation or savings.

- Auto-renewing: These require pre-deadline decisions, or you risk getting locked in.

- Mission-critical: Tools that power core workflows or customer-facing services have major business implications.

- Complex license models: These are easier to overpay for and harder to scale appropriately.

This tiered approach helps you focus your time and negotiation effort where it matters most.

6. Use renewal time to optimize contracts, not just renew them

Too often, teams treat software renewals as a formality. But every renewal is an opportunity to improve your stack. Take this time to:

- Optimize license counts based on actual usage trends (e.g., drop unused design tool seats)

- Switch pricing tiers to match your usage patterns better (e.g., move from enterprise to growth plans if your usage dropped)

- Consolidate tools with overlapping functionality (e.g., project management tools used by different teams)

- Push vendors for better terms (e.g., discounts or new contract models)

Stitchflow shows exactly where you’re over-licensed or paying for duplicate tools, so renewals become a chance to cut waste instead of carrying it forward.

"During renewal prep, Stitchflow flagged 40+ unused licenses we hadn’t caught. That insight let us cut our contract by 30% instead of rolling it over."

— a Stitchflow customer

💡 Compare to benchmark pricing

Once you’ve validated license usage, request an updated quote from your vendor and compare it against market benchmarks via tools like Vendr or G2. This ensures you walk into negotiations with leverage and prevents overpaying simply because “that’s what you’ve always paid.”

Plan ahead to sync with your budget cycles

Timing your software renewals around your company’s budget cycle helps prevent unexpected costs and ensures each renewal gets proper attention. We suggest you audit all software—irrespective of renewal data—at least 60–90 days before your annual budget is finalized.

Then, combine usage data with upcoming business needs to estimate how much funding each renewal will require. That way, you can allocate budget first to high-cost or mission-critical tools, and plan smaller renewals later in the cycle.

📚Also read: How to optimize SaaS renewals with Stitchflow

Eliminate renewal risk from disconnected apps

Disconnected apps are the #1 source of renewal risk, and they exist for one main reason: the SCIM Tax.

Because vendors gate SCIM behind expensive enterprise plans, IT teams are stuck managing these apps manually. This means logging into dozens of browser tabs for every new hire or termination.

When a single deprovisioning step is missed, that account becomes "orphaned"—a security gap and a guaranteed wasted license at renewal.

This is the core problem Stitchflow was built to solve.

We provide SCIM for apps without SCIM. We turn any app with a web UI into a fully automatable service for your IDP.

How? We use resilient browser automation maintained by a 24/7 human-in-the-loop (HITL) reliability team. When a user needs to be deprovisioned, our automation securely logs into the app's admin console and performs the exact steps a human would.

If the UI changes or a CAPTCHA appears, our on-call engineers step in to fix it instantly.

The result is that your deprovisioning workflows don't fail. Orphaned accounts are never created, and you have a full, auditable, video-recorded trail for compliance. You stop finding renewal waste and start preventing it at the source.

How to know if you should renew your software?

Here’s a list of questions you can ask yourself before you commit to another month —or year:

- Are employees actively using the tool, or have seats gone idle? Look at login frequency, activity levels, and which departments actually rely on it.

- Do you have more licenses than you need for the current team size? Check if seats were purchased for growth that never happened, or if roles have shifted.

- Is the tool delivering measurable value, or could another option replace it? Compare cost against usage and outcomes—sometimes consolidation or alternatives are more effective.

- Has adoption increased, stayed flat, or declined over the last 6–12 months? A downward trend can indicate the tool is being replaced organically by other apps.

Are there overlapping tools in the stack? Multiple apps may serve the same function (e.g., project management, messaging, file storage). - Are any accounts tied to ex-employees or contractors? These orphaned licenses drive up renewal costs and create security risks.

- Does the vendor’s renewal contract include auto-renewal, minimum seat commitments, or SSO/SCIM upgrade requirements? These clauses can lock in unnecessary costs if not caught in advance.

Here’s where tools like Stitchflow can come in handy. You can:

- See real usage data across every app to spot inactive or underused licenses.

- Run Slack surveys to ask employees directly if they still need a tool

- Review trend reports that show adoption and engagement over time, so you know if usage is growing, flat, or declining

How Stitchflow transforms SaaS renewal management

Software renewal management fails when manual (de)provisioning processes fail. This isn't an accident; it's often by vendor design.

Vendors lock critical automation features like SCIM behind expensive, "all-or-nothing" enterprise plans—what we call the "SCIM Tax".

This "Ransom Economics" forces IT to manage disconnected apps by hand, guaranteeing errors, security gaps, and wasted licenses.

Stitchflow transforms this by replacing those failed manual processes with guaranteed, reliable automation.

- For IT teams: Stop wasting days manually logging into dozens of browser tabs for every new hire or termination. Stitchflow's SCIM bridge provides real-time (de)provisioning for 100% of your apps, even legacy tools, via managed browser automation. This closes offboarding gaps the moment they happen. The "audit-ready report" you get at renewal time is no longer a to-do list; it's a clean bill of health.

- For finance teams: Stop paying the "SCIM Tax". When a vendor demands a $50,000 upgrade just for automation, Stitchflow gives you the leverage to say no. We provide that same mission-critical automation—backed by a 24/7 human-in-the-loop reliability team—for a fraction of the cost. This allows you to renew on your existing, cheaper plan while still getting the automation you need.

The result: renewals become a controlled, proactive process. You stop finding waste at the last minute and start preventing it, every single day.

Want to learn more? Book a free demo and we’ll show you how Stitchflow's managed automation can solve your most painful (de)provisioning gaps and help you avoid the SCIM tax on your next renewal.

Frequently asked questions

Businesses can avoid last-minute renewals by centralizing all software contracts, license counts, and renewal dates in one system—like Stitchflow. This automatically tracks renewal deadlines, pulls real-time usage data, and alerts IT and Finance well before contracts expire.

Jane is a writer at Stitchflow, creating clear and engaging content on IT visibility. With a background in technical writing and product marketing, she combines industry insights with impactful storytelling. Outside of work, she enjoys discovering new cafes, painting, and gaming.